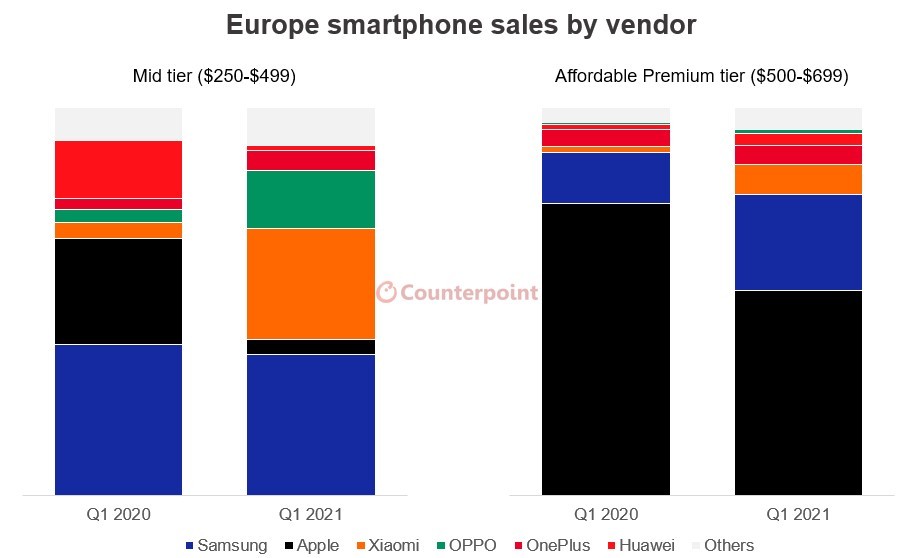

Huawei is now all however gone from the Western market. It was highly popular in the sub-$ 250 segment, however the companies that demolished its market share selected to concentrate on the greater price tiers instead. The analysts argue this is why the $250-$ 500 and $500-$ 700 segments grew even during an economic downturn triggered by the pandemic. There is now a lack of appealing sub-$ 250 devices.

Source

Support for the next-gen networks is only part of the story– the mid-tier ($ 250-$ 500) and “affordable premium” tier ($ 500-$ 700) are what drove the growth of smartphone sales on the Old Continent in 2015. And this came at the expense of Huawei.

Reasonably new brand names such as Xiaomi, Oppo and OnePlus revealed a significant four-fold boost in sales compared to Q1 last year. Over one third of phones sold in the economical and mid premium tiers now originate from these three companies.

In the very first quarter of last year there were no mid-range 5G phones readily available on the European market. Then in Q3 they comprised 20% of the sector. In the very first quarter of this year 5G mid-rangers account for half of gadgets offered in Europe in the $250-$ 500 range, according to Counterpoint Research.

That is putting pressure on Apple and Samsung in those segments, but according to Counterpoint the 2 market leaders are not safe even in the flagship sector as Xiaomi, Oppo, OnePlus, Realme and vivo all getting traction. They are dealing with collapsible flagships, which will increase the pressure on Apple and Samsung even more, predict the experts.