The growing breadth of IoT gadgets, makers, and use cases integrated with extra radio spectrum and procedures is creating more complexity in designing and incorporating antennas into items.

A new analysis by worldwide tech market advisory firm ABI Research examines how the antenna market is progressing to resolve challenges particular to IoT and finds that growing competitors and technology complexity will drive 7.2 billion IoT antenna deliveries in 2025.

The report also highlights essential innovation trends, as well as shifting business models by antenna producers and system-level methods to RF design.

Tancred Taylor, IoT Hardware & & Devices Research Analyst at ABI Research, says:

” Increased radio complexity, gadget miniaturization, lower power consumption, and a complicated accreditation landscape are among numerous elements making combination of antennas harder.”

” These obstacles are widely known in the mobile phone market. Nevertheless, unlike the smart device market which comprises couple of OEMs and high product volumes, many OEMs in IoT do not have the in-house expertise to address this complexity and have a much broader range of items they wish to produce. This produces a big chance for antenna producers to use assistance and extra services throughout the project style cycle and offer worth by moving beyond their traditional function as element makers.”

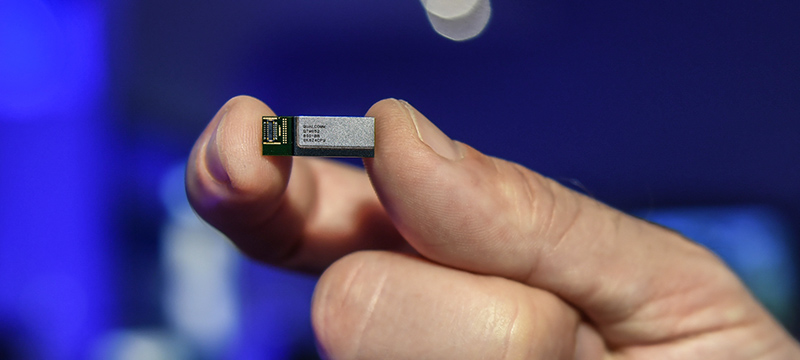

Suppliers are changing their approaches to ensure they are attending to the special needs of each gadget. Makers such as Antenova or Ignion are constructing out their off-the-shelf product lines to enhance or change customized antenna offerings, helping smaller sized OEMs get devices to market quicker, with less intricacy, and often with lower costs. “While use case analysis shows custom-designed antennas will remain the largest share of shipments, the shift towards providing a wider selection of tunable and pre-built elements might disturb the supremacy of customized antennas by making IoT gadget style and product assembly more available,” Taylor explains.

Other suppliers, such as Laird, Taoglas, Linx Technologies, or PSA Group are increasing the product portfolios to function as a one-stop-shop for more parts of the option, as well as working more carefully in partnerships with other vendors to bring joint products to market and simplify design and accreditation processes. A potentially disruptive entry to the one-stop store provider group is Quectel, the largest provider of modules, who just recently included antennas to their portfolio.

In a field where technology advancements should clear constraints of physics, numerous antenna suppliers are additional turning towards software application and services to deliver the very best outcomes. Approaches vary from providing design and simulation services or accreditation support (e.g., Radientum, CoreIoT), to assisting an OEM throughout the design cycle of an item (e.g., Taoglas, Laird, Airgain). Antenna manufacturers are wanting to evolve their abilities and capabilities by incrementally constructing out in-house proficiency, along with through acquisitions.

Antenna OEMs need to believe strategically about their organization models to remain pertinent in not just a more competitive market however also a significantly diverse technological landscape. “Both business and technical variables require factor to consider ranging from collaborations that enhance element interoperability and broaden sales channels, to brand-new innovations such as active antenna systems and dynamic tuning chips. It will become increasingly common to see vendors with a breadth of services and products,” Taylor concludes.

Producers such as Antenova or Ignion are constructing out their off-the-shelf item lines to enhance or replace custom antenna offerings, assisting smaller sized OEMs get devices to market faster, with less intricacy, and frequently with lower costs. “While usage case analysis shows custom-designed antennas will stay the biggest share of deliveries, the shift toward using a broader selection of tunable and pre-built components might upset the supremacy of custom antennas by making IoT device style and item assembly more available,” Taylor describes.

Antenna OEMs require to believe strategically about their company models to stay relevant in not only a more competitive market however likewise a progressively varied technological landscape.