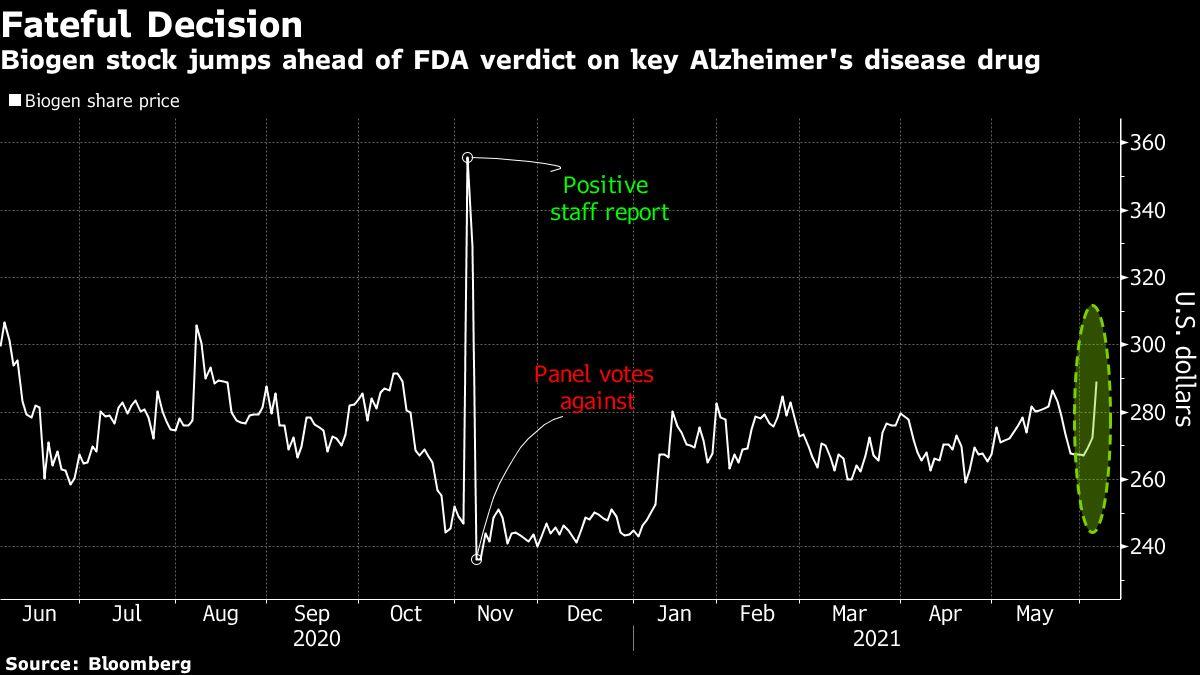

Or it could tumble to $200 if the treatment is shot down, according to Cory Kasimov, the JPMorgan expert who follows the company.The stock rose as much as 7% to $291.71 in Friday trading, its the greatest intraday jump for Biogen given that Jan. 29.”Biogens stock has actually traded sideways considering that November, when it rose on an FDA staff report that said aducanumab appears reliable, only to then topple when an outside panel of firm advisers stated the information from a single trial wasnt adequate. The other are anxiety trial results from Biogen and partner Sage Therapeutics Inc. and data expected from Vertex Pharmaceuticals Inc. on a therapy forgenetic disorder.The SPDR S&P Biotech ETF, which carefully tracks smaller biotechs, has dropped 26% from Februarys record as financiers moved out of growth stocks that were extremely preferred during the depths of the pandemic.

(Bloomberg)– For Biogen Inc., the Food and Drug Administrations expected choice Monday on its Alzheimers drug is what a JPMorgan Chase & & Co. analyst called “the mother of all binary occasions”– one that might send its shares drifting dramatically in either direction.If regulators offer the business approval to market the drug, called aducanumab, the stock might surge to as much to $450, according to Wall Street analysts. Or it might tumble to $200 if the treatment is shot down, according to Cory Kasimov, the JPMorgan expert who follows the company.The stock rose as much as 7% to $291.71 in Friday trading, its the most significant intraday dive for Biogen given that Jan. 29. The projections show how heavily Biogens outlook is tied to the drug, the very first thats believed to slow the progression of the disease in individuals who show early signs of cognitive disability. Thats left Wall Street financiers and analysts trying to weigh whether regulators will quicken its approval regardless of mixed reviews that whipsawed the companys stock late last year.”The data bundle is inadequate, and with nearly any other sign, we think regulators would be requesting for another confirmatory trial pre-approval,” Kasimov wrote in a note.”But this isnt any other sign. Its Alzheimers. And the unmet need is rather unprecedented,” he composed. “Its anyones guess regarding what occurs next.”Biogens stock has traded sideways since November, when it surged on an FDA personnel report that stated aducanumab appears effective, only to then tumble when an outside panel of company advisors said the information from a single trial wasnt enough. Activity in bullish Biogen calls has picked up just recently, recommending the market is placing ahead of the June 7 decision date.The decision might also impact other drugmakers. Eli Lilly & & Co. is dealing with its own early Alzheimers drug, donanemab, which might be seen as having a much easier path if Biogens is approved. More unpredictable small-cap drugmakers are also pursuing their own treatments, including Cassava Sciences Inc., Annovis Bio Inc., Anavex Life Sciences Corp. and Prothena Corp.Story continuesThe FDA decision is one of three near-term events that could help turn around drooping investor belief on the biotech market, according to stock experts. The other are depression trial arises from Biogen and partner Sage Therapeutics Inc. and data expected from Vertex Pharmaceuticals Inc. on a therapy forgenetic disorder.The SPDR S&P Biotech ETF, which closely tracks smaller sized biotechs, has dropped 26% from Februarys record as investors shifted out of growth stocks that were extremely favored throughout the depths of the pandemic.”Buckle up for whats most likely to be an extremely important month for biotech investing,” Kasimov said in a research note.Jefferies expert Michael Yee also saw space for a sector turn-around ahead of the 3 drivers. “If net favorable, we might see sentiment improve as these are usually really liquid well-trafficked names and might cause the group to rally.”If the 3 occasions are negative? He said the sector might fall by another 10%.(Updates shares in 3rd paragraph)More stories like this are offered on bloomberg.comSubscribe now to remain ahead with the most trusted service news source. © 2021 Bloomberg L.P.