.

Graphite Bios innovation exactly finds and replaces genes, providing potential remedies for genetic illness. The gene-editing biotech is preparing to bring its most sophisticated restorative candidate into human screening later this year and its IPO raised $238 million for that program and others in its pipeline.

South San Francisco-based Graphite at first prepared to use 12.5 million shares in the range of $15 and $17 each. Late Thursday, the biotech increased the offers size to 14 million shares at the top of the projected cost range. Graphites shares will trade on the Nasdaq under the stock sign “GRPH.”.

Two other biotechs priced nine-figure IPOs today. See listed below for details about the stock exchange debuts of Elevation Oncology and Monte Rosa Therapeutics.

CRISPR technology finds the gene the biotech desires to fix, while a DNA repair system called homology directed repair (HDR) replaces DNA in that target gene. Graphite aims to establish its technology for gene correction, gene replacement, or the targeted insertion of genes into picked areas on the chromosome.

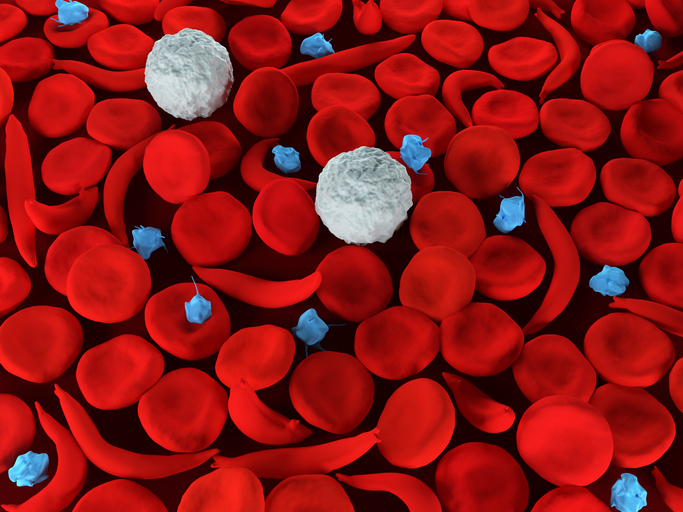

Gene correction is Graphites first test. The businesss lead program, GPH101, is a potential treatment for sickle cell illness, an inherited disorder stemming from a single mutation that triggers red cell to end up being misshapen. With GPH101, Graphite intends to get rid of the anomaly that causes the illness, changing it with the natural hereditary sequence. If it works, the treatment might bring back regular expression of hemoglobin, the oxygen-carrying protein in red cell. In mouse research studies, Graphite stated that its technique considerably increased regular adult hemoglobin expression, extended the life-span of red cell from two days to 19 days, and removed the sickling of those cells. The FDA has cleared Graphites prepare for a Phase 1/2 research study, which the company prepares to start in the second half of this year. Initial proof-of-concept data are expected by the end of 2022.

The start-up launched last September with $45 million in funding led by Versant Ventures. According to the IPO filing, Graphite has raised $197.7 million, most just recently a $150.7 million Series B round of financing in March.

The company has budgeted $40 million for the preclinical research study of GPH201, potentially leading to the start of a Phase 1/2 research study in X-linked extreme combined immunodeficiency. And $80 million is set aside for the businesss discovery-stage programs.

Elevation Oncology grabs $100M for targeted cancer drug.

Cancer treatments are moving toward targeted treatments directed to certain hereditary signatures on growths. Elevation Oncology is among a handful of companies establishing drugs that target neuregulin-1 (NRG1) blends. The business is performing a possibly critical test of its lead drug prospect, and it raised $100 million from its IPO to fund that research.

New York-based Elevation used 6.25 million shares at $16 each, which was the midpoint of its predicted $15 to $17 per share rate range. Elevations share will trade on the Nasdaq under the stock sign “ELEV.”.

NRG1 blends are uncommon genomic change that drive cancer development by activating HER3, which in turn sets off pathways for cell proliferation. Elevations drug candidate, seribantumab, is a monoclonal antibody that binds to the HER3 receptor, taking on NRG1 blend proteins, the business stated in its IPO filing. This approach is planned to prevent the HER3 signaling waterfall believed to set off the over activation of paths sustaining tumors.

Seribantumab was gotten from Merrimack Pharmaceuticals, which had actually stopped its work on the drug after interim information in a mid-stage lung cancer study revealed it did not enhance for how long clients live without the cancer progressing. Elevation is pursuing tumor-agnostic applications of the drug– treating any type of cancer as long as it has the NRG1 combination. Seribantumab is currently in a Phase 2 medical trial enrolling patients that have NRG1 fusion-driven solid tumors that have progressed after a minimum of one earlier treatment. Interim data are expected in late 2021 or early 2022.

Since forming in 2019, Elevation states it has actually raised $97.4 million. Aisling Capital is Elevations biggest investor, owning 11.6% of the biotech after the IPO, the prospectus shows. Since the end of the first quarter of this year, Elevation reported having $69.9 million in money holdings. Integrated with the IPO profits, the business prepares to spend between $60 million and $70 million to advance seribantumab through the conclusion of a Phase 2 clinical trial that the business thinks, if effective, might support the submission of an application looking for accelerated approval. The rest of the cash will money more advancement of the drug pipeline. The company estimates that its capital will support the business into the 2nd quarter of 2023.

” GLUE” sticks a $222.3 M IPO for protein-degrading drugs.

The field of protein destruction drugs is inviting another openly traded company with Monte Rosa Therapeutics $222.3 million IPO. The preclinical biotech had actually planned to sell 9.75 million shares in the variety of $17 to $19 each.

Cells have an integrated system for dealing with old or broken proteins. Drugs that utilize targeted protein degradation work by directing proteins connected with illness that disposal equipment, called the proteasome. The target protein is marked with a molecular tag that flags it for disposal. Not all proteins have binding sites for these molecules. Boston-based Monte Rosa intends to overcome that restriction with small molecules it calls “molecular glues.” In its prospectus, the company said its technology designs these molecular glue degraders, opening protein deterioration to illness previously considered “undruggable.”.

Monte Rosas most advanced program is developing little molecules that target a protein called GSPT1. According to the IPO filing, the business aims to deal with cancers driven by Myc, a family of genes that have actually eluded drug hunters. GSPT1 plays a key role in protein synthesis. By deteriorating that protein, Monte Rosa intends to activate the death of cancer cells. Lung cancer is the very first target. The company intends to start the preclinical research leading up to the submission of an investigational brand-new drug application (IND) in the 2nd half of this year with a formal filing of that documents in the very first half of next year.

Monte Rosa traces its origins to Ridgeline, a Versant Ventures incubator for drug discovery start-ups. Because its 2018 start, Monte Rosa has raised more than $220 million, most just recently a $95 million Series C round of financing in March. Versant Ventures is Monte Rosas largest investor, owning 20.5% of the company after the IPO, according to the IPO filing. New Enterprise Associates owns a 15.6% post-IPO stake.

Since March 31, the company reported having $168.4 million in cash. That capital, together with the IPO profits will be applied to the advancement of the drug pipeline. The GSPT1 program will receive between $47 million and $57 million to advance through Phase 1/2 testing. An approximated $120 million to $130 million is planned for advancement of other discovery programs; the business intends to bring a second program through Phase 1 testing; a 3rd one through the filing of an IND; and a fourth into IND-enabling research. Monte Rosa approximates that the company will have enough cash to money operations into the third quarter of 2024.

Image by Meletios Verras, Getty Images.

According to the IPO filing, Graphite has actually raised $197.7 million, most recently a $150.7 million Series B round of financing in March. Integrated with the IPO profits, the company prepares to spend between $60 million and $70 million to advance seribantumab through the conclusion of a Phase 2 clinical trial that the company thinks, if successful, may support the submission of an application seeking accelerated approval. Because its 2018 start, Monte Rosa has raised more than $220 million, most just recently a $95 million Series C round of funding in March. The GSPT1 program will get between $47 million and $57 million to advance through Phase 1/2 screening. An estimated $120 million to $130 million is prepared for development of other discovery programs; the business intends to bring a second program through Phase 1 testing; a third one through the filing of an IND; and a 4th into IND-enabling research.