.

The backbone of breast cancer treatment is a class of older drugs that deny growths of the hormonal agents that feed their development. Pfizer sees a new technique taken by an experimental Arvinas drug as the future of breast cancer care, and its committing $1 billion to the biotech in an alliance to further develop and potentially advertise the treatment.

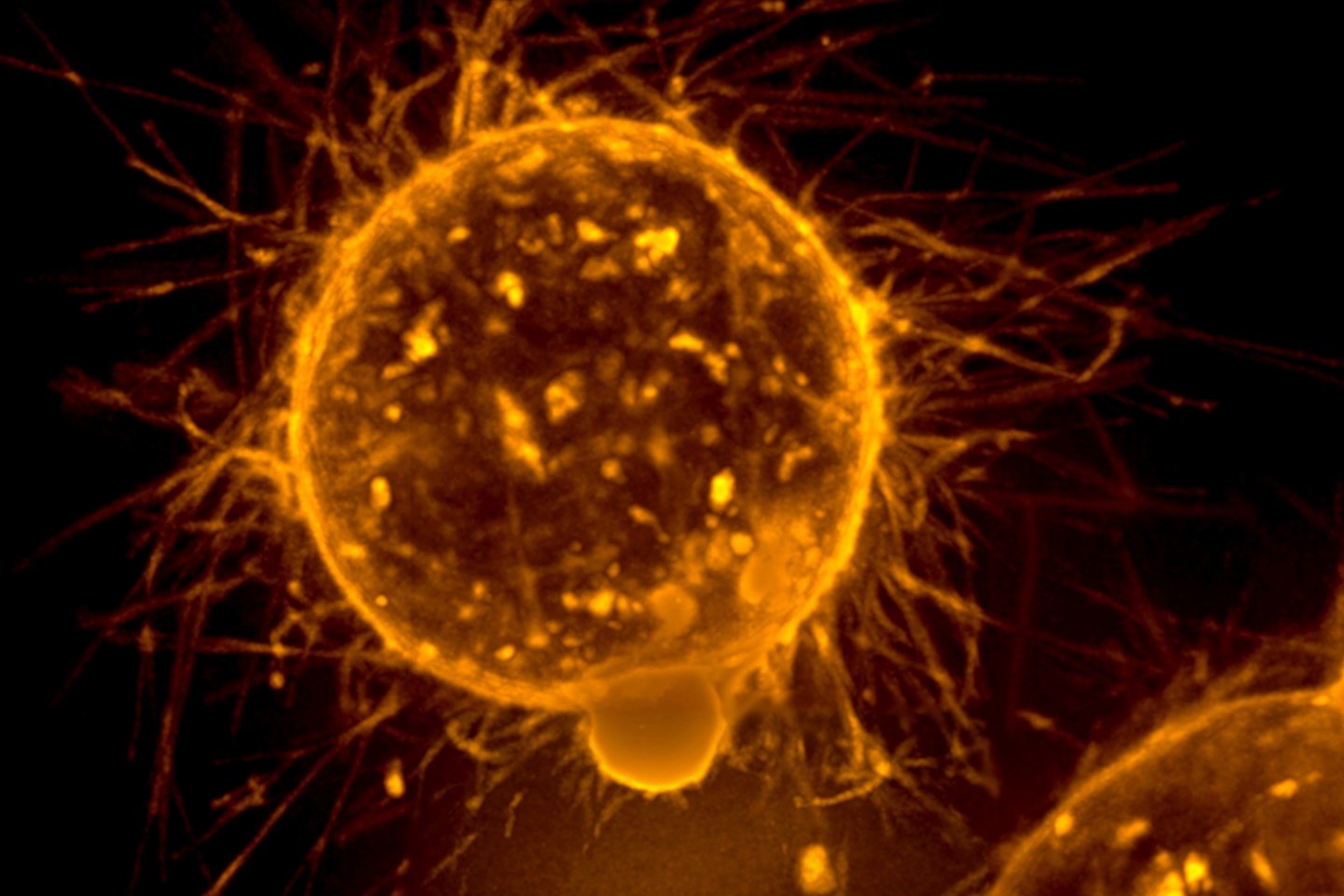

The experimental Arvinas treatment, ARV-471, becomes part of a new type of medications that take advantage of a cells integrated system for disposing of broken or old proteins as a way of getting rid of proteins that contribute or cause to disease, consisting of cancer. A number of biotech business are developing these targeted protein deterioration drugs. New Haven, Connecticut-based Arvinas is the first to bring such a drug into clinical screening for breast cancer.

” We are very thinking about innovative medications that could be possibly transformational and development medications, and this clearly is a first-in-category medication,” Chris Boshoff, senior vice president and chief development officer, Pfizer oncology said, speaking on a teleconference Thursday.

According to terms of the deal, Pfizer will pay Arvinas $650 million in advance. Different from that payment, the pharmaceutical giant is purchasing $350 million worth of shares in its partner at a 30% premium to the typical $101.22 rate of an Arvinas share over the past 30 days, as of Monday. The purchase represents an equity stake of about 7%.

Currently available cancer hormone therapies, such as AstraZenecas intramuscular injection fulvestrant, have actually verified the approach of degrading ER as a way of treating breast cancer, stated Ron Peck, primary medical officer of Arvinas. He included that these drugs take an indirect technique to degrading ER compared to targeted protein deterioration, in which a disease-causing protein is marked for disposal by the cells protein disposal system.

” That actually is an excellent point of evidence that more deterioration matters, and weve likewise shown that preclinically,” Peck said.

While the idea of degrading ER as a method of treating breast cancer isnt new, drug designers have actually been looking for much better methods to do it. A selective estrogen receptor degrader (SERD) that might be taken as a pill would have a benefit over injectable fulvestrant. Pfizer sees ARV-471 as the very best of the SERDS in development. It also sees the little molecule as a prospective mix partner with its hit breast cancer drug Ibrance, which produced $5.4 billion in global sales last year.

Pfizers interest in ARV-471 was stimulated last December when the biotech released initial information from a Phase 1 dose-escalation research study. In addition to showing safety and tolerability, the drug also showed strong anti-tumor activity. With those results, the company advanced the drug to Phase 1b, testing it in mix with Ibrance, a drug that works by obstructing the enzymes CDK 4 and 6.

” Were aware of the competitors out there with the other investigational oral SERDs,” said Andy Schmeltz, global president and general supervisor of Pfizer oncology. “All have the potential to surpass the existing requirement of care. Our company believe, based upon our diligence, that 471 is poised to be best in category, and naturally the mix of 471 with a CDK inhibitor, like Ibrance today, can potentially, downstream, in mix with other investigational CDKs in Pfizers portfolio, can truly be transformational.”.

Arvinas CEO John Houston stated that his companys December data drew partnering interest from “a variety of companies,” though he decreased to state how lots of. He included that Arvinas was trying to find a partner able to speed up the development of ARV-471 and advertise it broadly, while likewise enabling the biotech to keep the drug in its pipeline and share in the costs and risks of advancement.

Pfizer has actually currently been dealing with Arvinas under a 2017 alliance focused on finding targeted protein deterioration drugs. That partnership is different from the brand-new alliance on ARV-471. Under the arrangement announced Thursday, advancement and commercialization expenses for ARV-471 will be shared similarly. If the drug is authorized, Arvinas will be the marketing permission holder in the U.S., where it will reserve sales. Pfizer will hold marketing authorization for the drug in the rest of the world. Benefit from sales of an authorized ARV-471 will be shared equally, however the deal calls for Pfizer to pay Arvinas as much as $400 million in milestones tied to regulative approval, plus as much as $1 billion more in business turning point payments.

Arvinas has advanced ARV-471 to a Phase 2 dosage expansion trial testing it in patients with locally advanced or metastatic breast cancer that is ER favorable and HER2 unfavorable. The companies said that the medical advancement plan for the drug could consist of several worldwide, essential research studies.

Meeanwhile, the Arvinas pipeline has of 12 other completely owned targeted protein degradation drug prospects spanning cancer and neuroscience. The most advanced of those programs is ARV-110, which is in Phase 2 testing as a treatment for metastatic castration-resistant prostate cancer.

Public domain image by Stuart S. Martin through the National Cancer Institute.

New Haven, Connecticut-based Arvinas is the first to bring such a drug into scientific screening for breast cancer.

While the concept of degrading ER as a way of treating breast cancer isnt brand-new, drug designers have been trying to find much better ways to do it. It likewise sees the little molecule as a potential mix partner with its blockbuster breast cancer drug Ibrance, which produced $5.4 billion in international sales last year.

With those outcomes, the business advanced the drug to Phase 1b, evaluating it in combination with Ibrance, a drug that works by blocking the enzymes CDK 4 and 6.

Pfizer has already been working with Arvinas under a 2017 alliance focused on discovering targeted protein degradation drugs.